COVID-19 has generated a dramatic impact on digital marketing, the fashion industry, with incredible consequences for the whole market.

Considering that 80% of the corporates risk having financial distress, according to BoF – McKinsey report, we had the pleasure of hosting Shiyi Xu, Business Development Director for Fashion & Luxury at HyLink Digital, to know more about the current situation in China.

What we could learn about the resurgence of business after the pandemic? China was the first country to be heavily affected by the virus and it’s a market looked at with much interest from the rest of the world.

Even before the COVID-19, China was the world’s largest e-commerce market. To share a few numbers, 71% of the Chinese population owns a smartphone and it has almost 3 times the number of internet users as the United States. The record for sales on a single day on Alibaba was on 2019 Singles’ Day with over 35B € generated in just 24h, an impressive value that is yet to be replicated around the world.

The lockdown has accelerated the ongoing digitalization in China. Based on Hylink Digital Solutions research, various online activities have been growing since the COVID-19 outbreak such as:

• E-commerce: Alibaba and Tencent-backed JD.com Inc. reported that online sales of grocery, fresh products, and consumer essentials grew manifold during the quarantine, driving up the country’s online retail sales of physical goods by 3% to 1.123 trillion yuan in the first two months of the year. That is equal to around 912B €, more than the whole EU combined.

• Online-contents: E-learning has registered an incredible boost registering an increase of 40 million daily active users (DAUs) of education apps in China. Video services have also boomed, with platform iQiyi registering an increase of it DAUs of 21%.

COVID-19 has been the caveat for experimentation since 73,5% of consumers are open to trying new experiences online.

But what is very interesting is that consumers are willing to continue with many of these new online experiences such as e-learning, using home office software/app, medical consultancy, and paying for digital entertainment services.

The takeaway is that the new digital services may have longevity when this situation ends, making a dent also in the future and not only in this peculiar months.

Due to the pandemic, disruption has led to massive shifts in consumer behaviour. As people could not move freely around cities, their needs had to be satisfied with online solutions.

Remote work and enterprise communication tools have rapidly become new must-have. The productivity app market, which in China includes “Ding Talk” and “WeChat Work” as the leading tools, has helped this shift from off-line to on-line collaboration seamlessly.

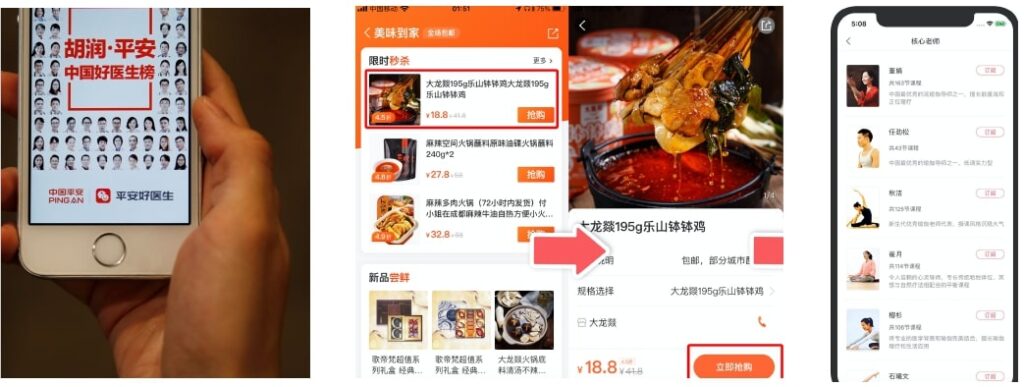

“Ping A Good Doctor” app grew 10 times in the number of newly registered users every day on average between January 22nd and February 6th.

Daily essential products have changed, there has been an increase in the contents related to recipes across Weibo, WeChat, Douyin (TikTok in China).

The fitness app, KEEP, ”saw an increase of 210 % in time spent in February 2020, month over month, as people in quarantine sought to stay active despite confinement,” AppAnnie -analytics and market data app- said.

Fitness influencers have also seen a significant uptake in traffic. Most of them have seen an exponential growth of followers and engagement numbers.

The COVID-19 outbreak has affected also the Fashion Weeks around the world. While Milan was entering the lockdown during the last days of MFW 2020, and hence not ready to cope with the situation, Shanghai was getting prepared.

The Shanghai Fashion Week, which happened some weeks later, became a full virtual Fashion show. After that first pilot, fashion events have been organized and deployed only through online platforms.

One of the most relevant impacts in China has been the way brands engage with their customers: a boom of live streaming and virtual entertainment has occurred.

“Content is not king anymore, but engagement is. Brands are focusing on building a deeper relationship that goes beyond transactions encompassing communities and a true sense of belonging (…)”.

Shiyi Xu

As an example, live streaming is already a multibillion-dollar industry in China, becoming the most profitable form of the digital market. According to the consulting company Deloitte, the market reached $4.4 billion in 2018, growing 37 % on the previous year and attracting a total of 456 million viewers. Brands could take advantage of this trend to deepen their relationship with their buyer personas, keeping an active line while the situation stabilizes.

The State of Fashion 2020 states that live streaming on the Chinese e-commerce website Taobao has increased >700% since the outbreak of COVID-19. While Taobao was already a major force, totalling almost 300M daily active users, these same users are looking forward to participating to live streaming sessions more than ever before.

Social-oriented influencers have gained importance: heroes, celebrities, and key opinion leaders (KOL).

KOLs promote products and influence sales, representing the main pillars of the Chinese marketing strategy. As we saw from live streaming, their relevance has grown during these challenging months.

Brands collaborate with KOLs who offer high-quality content and engaging experiences to users, providing an authentic and engaging story with the aim of compensating the decline of traditional digital advertising.

China witnesses a 117 % spike in lipstick sales this year during the important shopping season. It may appear counterintuitive, but KOLs are helping beauty brands to create a direct connection with their customers. Even though they cannot show their lipstick, consumers are looking forward to these purchases also for celebrating together and new trends are on the rise, such as custom lipsticks.

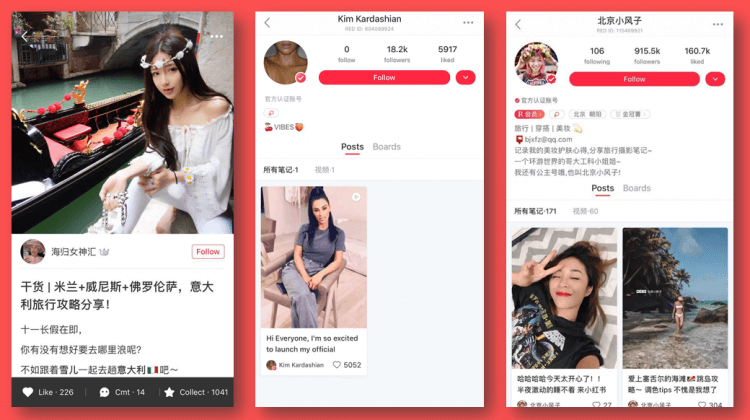

Social commerce is the future of retail in China. The latest Chinese platform for KOLs is the “Little Red Book” app. According to the social media agency WalktheChat, it is the number 1 ranking cross-border e-commerce app in China; a hybrid between social media and e-commerce.

It is a consumer-to-consumer platform, where consumers can discover and buy international products based on trusted user-generated content, via product review tutorials, blog posts, live streaming, and other innovative ways to boost online user numbers.

Louis Vuitton was the first luxury brand to launch an official account on Little Red Book with 130.000 followers.

Their live-streaming debut on Little Red Book was further proof of the brand’s strategy to invest deeply in the platform while also trying out a new type of shopping experience to suit the virus crisis.

They have had a quick adoption to the market and as a result, their live stream has created a positive engagement from viewers, garnering over 152.000 page views with an overflow of comments.

Now the majority of luxury brands are active in “A Little Red Book”.

During the lockdown, many Chinese companies have created a sales-strategy through discounts to cope with the crisis and the stores closed. For instance, as Reuters states, Alibaba has given 10 million discount coupons for 10.000 retailers.

Retail stores reopened on March 13th, and Ikea Wuhan opened on April 21st. Education has been resumed in “low-risk infection” provinces: having masks and checking the temperature. Also, over 95% of large enterprises resumed production.

Although many actors are talking about the Revenge Spending to happen in China, it seems the recovery will be not immediate. According to Hylink Digital Solutions, the 100% recovery is expected in June 2020.

COVID-19 is getting enterprises to finally pay attention to digital transformation. From cloud contact centres to warehouse automation, to autonomous delivery, to endpoint security; the future is moving forward out of necessity.

Giusy Cannone is Chief Executive Officer of Fashion Technology Accelerator.

She is the reference point for FTA’s corporate projects, also creating business connections for startups in the Acceleration Program and mentoring participants of our Masterclasses,